Big investors are dumping stocks in the U.S. at a record level.

Businessinsider.com reports:

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Latest Video

In a note Tuesday, Jill Carey Hall at Bank of America Merrill Lynch (BAML) wrote that the clients’ net sales of US stocks amounted to $4.1 billion last week, the largest total since January 2008.

Most of the selling is being led by institutional investors. Here’s Carey Hall:

After three weeks of net buying, institutional clients’ net sales last week were the largest in our data history. Hedge funds were net sellers for the ninth consecutive week, while private clients bought stocks last week following the previous week’s net sales. Buybacks by corporate clients were slightly lower than in the previous week, but on a four-week average basis have generally continued at a constant pace since mid-May. Net sales last week were chiefly due to large caps (biggest sales ever of this size segment), though small and mid-caps also saw outflows.

The strategists wrote that investors pulled the most money out of healthcare and financial stocks. Last week, outflows from healthcare were the largest on record, they said.

On Friday, BAML strategists noted that investors last week pulled the most from government bonds since the so-called taper tantrum of 2013.

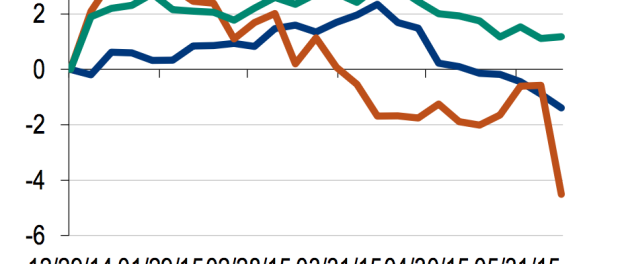

This chart shows that the various client types have steadily pulled money out of stocks in recent months, but institutional investors lead by far.