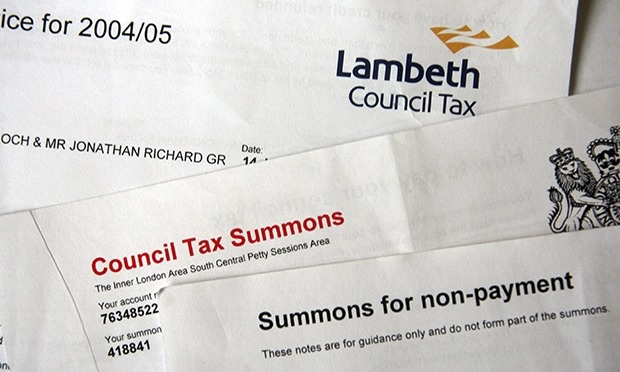

Local councils throughout the UK have been attacked for their excessive use of court orders and bailiffs to recover people’s debts rather than offering advice on affordable repayment plans.

RT reports: A survey by debt charity StepChange found that local councils are more likely to use aggressive enforcement measures to recover debts than they are to offer help.

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Latest Video

StepChange’s survey of its clients found that even after they spoke to their council about their money problems, 62 percent were threatened with court action and 51 percent were threatened with bailiffs.

Only 25 percent of people were offered the option of paying in affordable installments, and just 13 percent were encouraged to seek debt advice.

The report found that council tax debt is one of the fastest growing problems it has seen in the past four years, and is second only to payday loans.

Meanwhile, activists and unions have condemned local governments’ use of court orders and bailiffs as “scandalous.”

StepChange claims the number of people seeking help for council tax arrears has tripled since 2010, with the average level of debt increasing from £675 to £832.

According to the report, just over half of StepChange’s clients are families with children, while 64 percent are women.

A quarter of people who approach the charity for help with debt are single parent families.

The survey also found that many people who fail to keep up with council tax payments are struggling with other debts – including credit card loans, overdraft payments, and payday loans.

A spokesperson for StepChange said councils need to be more responsible in how they approach people with debt.