The government of Greece has pledged full support for privatisation on a national scale to her creditors.

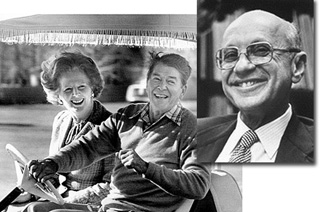

Greece’s Syriza party has done an about-face on the sell-off of state owned assets. The government of Alexis Tsipras wants to go back to the era of Margaret Thatcher, the British Prime Minister of the 1980’s who introduced the idea of modern capitalism with her guru Milton Friedman.

One could say the problems facing the Greek Treasury is the direct result of the policies of Milton Friedman, Margaret Thatcher and US President Ronald Reagan of the 1980’s. Their ‘economics of liberty’ is either going to set Greece free from her financial burden or ‘take the liberty’ out of Greece by confiscating her assets in a soft coup.

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Latest Video

ABC News reports:

Now, in an attempt to get a third European bailout and prevent the Greek economy from collapsing, the ruling party has done an about-face. It has pledged to fast-track the waterfront project, plus sell government assets and allow for private development of state-owned property, all to generate cash that will help reduce Greece’s 320-billion-euro national debt and pay back money lent by European nations to prop up ailing banks.

Experts say the goal set by Greece’s European counterparts for the country to raise 50 billion euros in privatizations and private use of state property is probably impossible — but that Greece must make a better effort than it has in the past.

but that Greece must make a better effort than it has in the past.

“There can be absolutely no backpedaling or unwinding with the privatization effort,” said Mujtaba Rahman, European director for the Eurasia Group political and business risk consulting firm. “This is about testing the government’s appetite to liberalize the economy and move forward with pro-market reforms.”

Big money assets that Greece could sell include state-owned stakes in Athens’ new airport, energy company Hellenic Petroleum and electrical utility Public Power Corp., plus offshore oil or natural gas drilling parcels. Greece also has stock in banks valued at 7.5 billion euros, but the true value of the stake is unknown because the Athens stock market stopped trading at the end of June as the country descended into financial chaos.

The Hellenic Republic Asset Development Fund, charged with matching state assets in deals with the private sector, also has parcels of land on beautiful islands available for long-term leases and a castle on the island of Corfu, plus buildings throughout Athens and across the country.

It was formed in 2011 following demands by Greece’s creditors to embark on a privatization wave, but has collected only 3.5 billion euros so far. Efforts have been complicated by constantly changing laws for asset sales, court challenges, local opposition, financial upheaval that makes it difficult to value assets, and criticism that prices have dropped so much that assets aren’t worth selling.

Proponents of privatization say it can help boost investment and the economy flourish by unleashing market forces. It was particularly popular in countries like the United Kingdom in the 1980s, when Margaret Thatcher sold state-owned assets including water and gas. Though privatizations have taken place elsewhere in Europe, they’ve been far less prevalent.

But over the past few years during Europe’s debt crises, privatizing assets has been a key demand placed on countries being bailed out. Greece notably failed to meet initial targets.

The privatizations have met with varying degrees of resistance, with some arguing that stressed governments such as Greece’s are selling assets at below-market prices. Opponents also say privatization reduces job security and transfers wealth to a rich elite.

Read more: abcnews.go.com/International/wireStory/greece-face-pledges-big-privatization-push