Last month Russia surpassed Saudi Arabia as the larget supplier of crude oil to China.

It follows Russia’s acceptance of the Chinese currency, renminbi as payments for her oil exports. Saudi Arabia may need to consider accepting the renminbi for her crude if she wants to regain her share of the Chinese market.

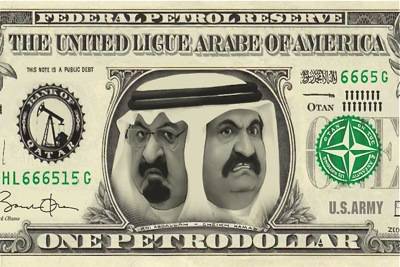

The tradition of accepting the Petrodollar goes back decades and ensures the survival of the desert Kingdom under the might of the U.S. and the dollar. Could Saudi Arabia abandon its long term commitment to the Petrodollar and start new partnerships? Or is her fate intertwined with the fate of the U.S. dollar.

Russia Insider reports:

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Latest Video

Russia Surpasses Saudi Arabia as Number One Exporter of Crude Oil to China; Petrodollar Under Threat?

Will Saudi Arabia abandon its 42-year long commitment to sell oil only in USD to win back Chinese market share? Could it?

Last month it became official – Russia is now the largest supplier of crude to China, having passed Saudi Arabia. According to Bloomberg, in May of this year China imported more than 3.9 million metric tons of Russian crude. That translates into over 900,000 barrels a day, or a 20% increase from the previous month. Conversely, imports from Saudi Arabia plummeted by 42% from April.

Again from Bloomberg:

“Following Russia’s recent acceptance of the renminbi as payments for oil, we expect more record high oil imports ahead to China,” Gordon Kwan, the Hong Kong-based head of regional oil and gas research at Nomura Holdings Inc., said in an e-mail, referring to the Chinese currency. “If Saudi Arabia wants to recapture its number one ranking, it needs to accept the renminbi for oil payments instead of just the dollar.”

Now if that latter quote is true, then Saudi Arabia has a problem. The Kingdom is currently at the crossroads between the global order of the last 70 years and the global order of the next who-knows-how-many years; and it’s going to have to make some tough decisions – some very tough decisions – and very soon.

Saudi Arabia’s current predicament was born in 1973. The Kingdom cut a deal with the Nixon administration to sell its oil exclusively in USD in exchange for U.S. protection and arms, and in order to create an artificial worldwide demand for the greenback, which had been taken off the gold standard two years earlier.

This deal resulted in the petrodollar cycle, whereby the U.S. can continuously print its currency with little to no regard for inflationary problems, as everyone who needs to buy oil – which is everyone – has to gobble up U.S. dollars in order to do it.

The cycle is like a never-ending free lunch, or a credit card with no limit that never has to be paid back. It is, in essence, the source of American economic and military might. The petrodollar is the linchpin of American hegemonic power; and Saudi Arabia is the linchpin of the petrodollar. Quite a responsibility.

China, with its economy shifting toward more of a consumption-based model with rising domestic purchasing power, would clearly prefer to buy with its own currency.

If Russian imports continue to rise under the new currency arrangement, and if the disparity between Russian and Saudi exports continues to widen, can Riyadh really afford to keep itself restricted to the dollar? At the same time, if it did decide to sell outside of the dollar to recapture, if not retain Chinese market share – and automatically threaten the petrodollar in the process – could it possibly expect to meet with anything less than the full strength of American displeasure, if not outright fury?

Saddam Hussein sold his oil for Euros back in 2000 and was hanging from a rope shortly thereafter. Muammar Ghaddafi wanted to sell his oil for gold and was brutally lynched by a howling street mob. One would have to be blind in the dark not to see the connection here.

Russia is not a potential candidate for this brutish treatment, but Saudi Arabia is. If the Kingdom were to roll the dice and successfully sell its black gold outside of the greenback, would other states (OPEC) not also follow? And if they did, would that not be the beginning of the end of the petrodollar? Would it not be the end of America in its current form and as we’ve always known it? And finally, would it not be the beginning of a very violent and bloody series of regime changes throughout the region in the name of ‘spreading democracy’ or some other such nonsense?

Russia’s boldness in moving out of the dollar, coupled with the Renminbi’s inexorable rise, have combined to put Saudi Arabia in quite a precarious position; and it will be very interesting to see how the Kingdom walks this very fine and delicate line.