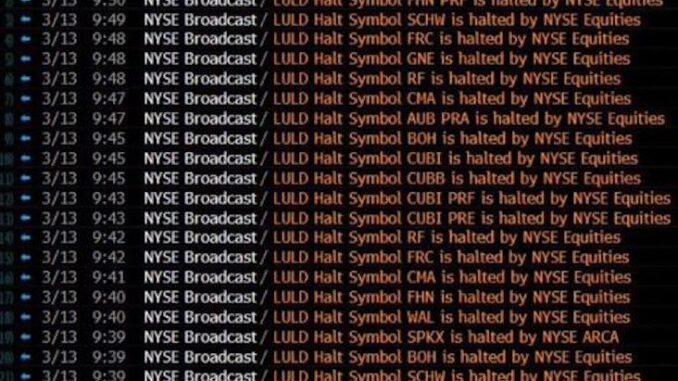

Chaos erupted on Monday as trading was abruptly halted at over 30 banks across the United States, leaving investors reeling and the markets in disarray. Charles Schwab, one of the largest brokerages in the country, was among the banks affected, with trading brought to a sudden standstill.

The halt in trading was prompted by a wave of panic-like activity among investors in the wake of the recent failures of several prominent financial institutions, including Silicon Valley Bank and Signature Bank. With bank stocks experiencing unprecedented levels of volatility, the Nasdaq’s “Current Trading Halts” page was inundated with requests from anxious investors seeking to check the status of their holdings.

BYPASS THE CENSORS

Sign up to get unfiltered news delivered straight to your inbox.

You can unsubscribe any time. By subscribing you agree to our Terms of Use

Latest Video

Multiple banks had their stock halted for volatility, some more than once, since the opening bell, with the largest banks suffering the heaviest losses. Among those that were halted at least twice, shares of Western Alliance Bancorp plummeted a staggering 78.2%, while Regions Financial Corp. sank 15.6%, First Republic Bank plunged 65.5%, Comerica Inc. tumbled 39.4%, and PacWest Bancorp. took a 47.7% dive.

The sudden selloffs sent shockwaves through the financial community, with many experts predicting dire consequences for the broader economy. As the markets struggled to regain their footing, the S&P 500 inched up by a mere 0.1%, erasing an earlier drop of as much as 1.4%.

Despite the efforts of regulators to restore calm, the situation remains volatile and unpredictable, leaving investors scrambling to protect their assets and brace for what many fear could be a prolonged period of turbulence in the financial markets. As the dust settles, the question on everyone’s mind is: what comes next?